Labour Practices and Decent Work Responsibility

Revamping the e-Learning Programme

The e-Learning roll out was further revamped during the year. The learning service was enabled for all staff and by year-end 46 courses had been installed on the system. A total of 491 staff members followed the online courses, and further efforts are being made to improve the system and cater to a wider pool.Non-Training-Related HR Initiatives

The year also saw the Bank undertaking several important non-training-related initiatives, some ongoing, including the following:- A ‘360 degree assessment’ for Corporate Managers with more than 3 years of service remaining with the Bank, with each participant receiving an individual report whose findings will feed into future personal development planning.

- A market survey to ascertain the Bank’s relative position in terms of compensation and benefits to staff; findings to be used in relation to collective agreements and revision of executive compensation packages.

- An ‘employee engagement survey’ polling 3,374 respondents; findings shared with top management and employee organisations, and to be acted upon during 2012.

- Support for branch expansion drive through recruitment, training and staff allocation.

- Efforts towards better utilisation of staff at branches, with staff allocations based on branch location and business volume.

- Efforts to improve trainee intake quality through further strengthening our brand-image as an employer of choice, carrying out recruitment drives at selected schools, and revising our training processes.

- Building closer relationships with employee organisations.

- Successful negotiation of collective agreements with representative employee unions, covering non-executive staff and junior executives for the period 2012-2014.

- Rewarding selected staff with seniority and attendance awards.

- Providing a 10% increase in pensions for all pensioners of the Bank.

- Organising a variety of social events for staff, including the very popular Combank Quiz.

- Publication of the Bank’s HR Manual in compliance with a Central Bank Guidelines.

- Implementing a number of employee suggestions relating to sales and service enhancement as part of an interactive feedback process.

- Ongoing publication of the Bank’s internal newsletter, Com Pulse.

- Developing the log book of Banking Trainees and work-based training guide.

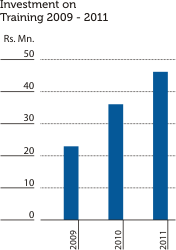

Our Investment on Training

To further strengthen the staff development process the Bank increased its investment on training from Rs. 36.032 Mn. in 2010 to Rs. 46.151 Mn. in 2011. This 28.08% increase will also support our intensive efforts to improve customer experience across all business units, with long term benefits accruing to the Bank.Career Development Review

All employees of the Bank irrespective of their gender received formal performance and career development reviews during 2011. Annual performance reviews and the reviews conducted upon completion of probationary periods, help the Bank in identifying and enhancing the salient skills and developing them as needed.

Equal Remuneration for Women and Men

The ratio of basic salary of men to women by employee category is tabulated below:| Ratio of Basic Salary Women to Men |

||

| Category | 2011 | 2010 |

| Corporate Management | 1:1.57 | 1:1.72 |

| Executive Officers | 1:1.00 | 1:1.04 |

| Junior Executive Assistants and Allied | 1:0.95 | 1:0.90 |

| Banking Trainees | 1:0.96 | 1:0.98 |

| Office Assistants and Others | No female office assistants are employed by the Bank | |

Outlook

In the coming year, steps will be taken to further enhance productivity, including a closer alignment of the workforce plan with the business plan. Personnel costs accounted for 37.44% of the Bank’s total operating costs in 2011, and with a cost income ratio of 51.66%, this is an area that will continue to receive considerable attention in the years to come.Feedback received during the employee engagement survey identified specific areas where action is needed. This includes devising viable career paths for all staff categories; improving process efficiency by effecting transfers with a minimum of disruption to the business; and improving the support services available to employees. The Bank is also looking to improve communication among staff through the ‘One Bank, One Family’ concept.

An expected rise in retirements will cause several leadership positions to fall vacant in the years to come. We are working on creating an internal talent pool that is competent to fill these vacancies by enhancing managerial competencies through specific development interventions and by fast-tracking employees with high potential, as well as by maintaining transparency with respect to the career progression and mobility for all staff. We will also strive to improve engagement amongst less productive staff.

The Bank will continue to benchmark and provide a fair and attractive compensation package for all levels of staff, while improving the quality of the Bank’s staff appraisal process.