Labour Practices and Decent Work Responsibility

New Employees Hired and Attrition

During the period 2009 to 2011, the Bank hired 871 new staff members, details of which by employee grade are given below:| Category | No. of Employees Hired | ||

| 2011 | 2010 | 2009 | |

| Corporate Management | 2 | 2 | – |

| Executive Officers | 8 | 9 | 6 |

| Junior Executive Assistants & Allied | – | – | – |

| Banking Trainees | 343 | 367 | 134 |

| Office Assistants & Others | – | – | – |

| Total | 353 | 378 | 140 |

There were 120 resignations from service during the year under review, while a further 18 employees retired, in the total turnover of 147 employees.

Details of staff attrition by age, gender and region are tabulated below:

Details of staff attrition by age, gender and region are tabulated below:

| No. of Employees | Percentage of Employees | |||||

| 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | |

| Resignations | 120 | 88 | 85 | 81.63 | 78.57 | 77.98 |

| Retirements | 18 | 15 | 18 | 12.24 | 13.39 | 16.52 |

| Deceased | 4 | 4 | 2 | 2.72 | 3.57 | 1.83 |

| Terminations | 4 | 5 | 4 | 2.72 | 4.47 | 3.67 |

| Premature Retirement on Medical Grounds |

1 | 0 | 0 | 0.69 | 0.00 | 0.00 |

| Total | 147 | 112 | 109 | 100.00 | 100.00 | 100.00 |

| Employee attrition of the Sri Lankan Operation of the Bank increased marginally in comparison with the past two years due to improved employment opportunities present in the country. |

||||||

Gender-Wise Employee Turnover |

||||||

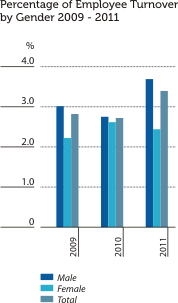

| Gender | Gender-Wise Turnover

|

Gender-Wise Percentage of Attrition (%) |

||||

| 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | |

| Male | 122 | 86 | 88 | 3.69 | 2.75 | 3.02 |

| Female | 55 | 26 | 21 | 2.44 | 2.62 | 2.22 |

| Total | 147 | 112 | 109 | 3.40 | 2.72 | 2.82 |

Total Number and Percentage of Employee Attrition by Age Group

| Age Group | No. of Employees Left

|

Percentage of Employee Attrition Rate (%) | ||||

| 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | |

| 51-60 years | 29 | 25 | 23 | 10.21 | 8.96 | 8.98 |

| 41-50 years | 8 | 9 | 8 | 1.27 | 1.57 | 1.46 |

| 31-40 years | 18 | 23 | 16 | 1.72 | 2.41 | 1.76 |

| 21-30 years | 87 | 54 | 61 | 3.82 | 2.45 | 2.88 |

| 20 years and below | 5 | 1 | 1 | 5.95 | 0.91 | 3.13 |

| Total | 147 | 112 | 109 | 3.40 | 2.72 | 2.82 |

Province-Wise Employee Turnover

| Province | Turnover (No.) | Turnover (%) | ||||

| 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | |

| Central | 9 | 6 | 14 | 3.41 | 2.25 | 5.45 |

| Eastern | 9 | 5 | 3 | 9.09 | 6.02 | 5.77 |

| Northern | 6 | 13 | 4 | 3.45 | 8.78 | 3.70 |

| North-Central | 2 | 2 | 2 | 2.38 | 2.74 | 3.03 |

| North-Western | 6 | 4 | 7 | 2.52 | 1.82 | 3.47 |

| Sabaragamuwa | 3 | 4 | – | 1.86 | 2.74 | – |

| Southern | 10 | 2 | 8 | 3.17 | 0.65 | 2.75 |

| Uva | 2 | 2 | 1 | 2.30 | 2.78 | 1.67 |

| Western | 100 | 74 | 70 | 5.65 | 2.64 | 2.60 |

| Total | 147 | 112 | 109 | 3.40 | 2.72 | 2.82 |

Benefits Policy and Regime

The Bank follows a policy of continuous improvement in respect of the working lives of its employees. In addition to the provisions regarding employee welfare and benefits under the Shop and Office Employees’ Act, Commercial Bank has taken further steps to enhance the facilities and benefits afforded to its staff.- Performance-related bonus or bonus under the collective bargaining agreement.

- Fuel allowance for executive cadre and transport allowance for non-executive cadre.

- Holiday bangalows.

- All staff are members of a private provident fund administered by an Independent Board of Trustees according to the provisions of the Employees’ Provident Fund Act and the regulations framed from time to time thereunder. In addition, employees who were entitled to a pension at the time of hiring are now entitled to participate in an alternate terminal-benefits plan where such benefits are offered as a single lump-sum payment.

- Medical benefits enjoyed by all employees include special health insurance cover for critical illnesses and staff loan schemes (at concessionary interest rates) to tide over an illness in the family.

- The Bank’s death gratuity scheme entitles the legitimate dependants of a confirmed employee (who is not subject to the alternate terminal benefit plan described above) to a compassionate payment of two months’ gross salary for each year of completed service (subject to a minimum of nine months’ gross salary) in the event of his or her demise. Under the group life policy, those dependants also receive a sum equal to 24 months’ salary (based on the last drawn salary) of the deceased.

- The Bank also operates a personal accident insurance scheme which, in the event of an accident causing the death of an employee, entitles his or her legal dependants to a sum equal to 60 months’ salary as last drawn.

- Staff members assigned to the various branches of the Bank may be entitled to certain benefits designed to offset the difficulties and hardships arising from employment at a particular branch. Depending on staff requests and the recommendation of the Regional Manager under whose purview the branch in question operates, an employee may receive benefits such as the provision of staff accommodation free of charge, transport, a difficult-station allowance or a house rent allowance.

- The reimbursement of selected professional-association subscriptions and the honoraria paid to employees provide further examples of the Bank’s commitment to its employees’ welfare.