Managing Risk at Commercial Bank

Quality of a portfolio from a market risk perspective is measured by working out Marked-to-Market (MTM) value at a given time, specifically in relation to Fixed Income Securities (FIS). MTM operation is independently carried out by the Treasury Middle Office. Market rates are obtained from independent sources such as Central Bank of Sri Lanka, Reuters or Bloomberg system in order to maintain transparency.

In view of the fact that the Bank did not have a major exposure to Commodity Risk and Equity Risk during 2011, Market Risk exposure of the Bank was measured mainly in terms of Interest Rate Risk (IRR) and Foreign Exchange (FX) Risk. These measures cover traditional banking related products which are exposed to IRR, FX Risk and Funding & Concentration Risk. Accordingly, the Bank has developed a sound and well-informed strategy to manage market risk through the establishment of policy parameters and guidelines within which the business units creating such exposures operate, in order to optimise the risk-return trade off. Few of the indicators listed here assist the Bank to objectively manage the market risk exposures at prudent levels. Indicators identified for measurement are assessed and periodically monitored at various management committees as discussed under Market Risk Management Structure.

In view of the fact that the Bank did not have a major exposure to Commodity Risk and Equity Risk during 2011, Market Risk exposure of the Bank was measured mainly in terms of Interest Rate Risk (IRR) and Foreign Exchange (FX) Risk. These measures cover traditional banking related products which are exposed to IRR, FX Risk and Funding & Concentration Risk. Accordingly, the Bank has developed a sound and well-informed strategy to manage market risk through the establishment of policy parameters and guidelines within which the business units creating such exposures operate, in order to optimise the risk-return trade off. Few of the indicators listed here assist the Bank to objectively manage the market risk exposures at prudent levels. Indicators identified for measurement are assessed and periodically monitored at various management committees as discussed under Market Risk Management Structure.

1. Interest Rate Risk

- Interest Rate Risk (IRR) is the impact on interest income of the Bank due to possible changes in market interest rates as compared to current level. IRR constitutes the most significant component of market risk exposure of the Banking Book. Hence, the Bank monitors IRR on an ongoing basis giving due consideration to re-pricing characteristics of all assets and liabilities. Rate shocks of different magnitudes are applied to all assets and liabilities at regular intervals and the impact is monitored to ensure that the Bank’s earnings are within internally set parameters. Decisions to exceed such parameters taken at ALCO after giving due cognisance to market factors in order to optimise risk-reward tradeoff. Accordingly, the Bank has been successful in managing the Net Interest Income (NII) favourably even amidst the rising interest rate scenario experienced during the latter part of year 2011.

- Basis Risk, the risk that products with similar characteristics get re-priced differently, is also a factor contributing to the IRR of the Bank. In order to assess the potential contribution of basis risk towards IRR, ALCO monitors the movement of the Prime Lending Rate (PLR) and Government Securities rates to make informed decisions on pricing and portfolio rebalancing.

- Gap Analysis on Rate Sensitive Assets (RSA) and Rate Sensitive Liabilities (RSL) is monitored periodically to decide on suitable strategies to mitigate exposure to IRR based on future interest rate forecasts.

2. Foreign Exchange Risk

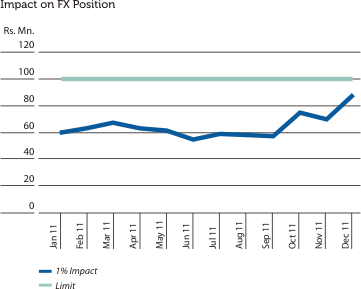

- Foreign Exchange Risk is the possible impact on earnings and capital due to fluctuations in exchange rates. This may arise as a result of existing maturity mismatches of foreign currency positions.

The Bank is exposed to foreign exchange risk, whenever it undertakes transactions in any currency other than Bank’s base currency, i.e. Sri Lankan Rupee (LKR).

Risk tolerance limits for FX exposures set by the Bank, which are more stringent compared to the regulatory limits of Central Bank of Sri Lanka (CBSL) parameters, ensure that the Bank maintains the un-hedged FX positions at an acceptable level to prevent potential losses from adverse fluctuations in FX rates. - The Bank is also exposed to FX Risk due to both FX transaction and translation risks. FX transaction risk, the possibility of incurring exchange loss/gain on transactions already entered into and denominated in a foreign currency, is identified by providing suitable exchange rate shocks to capture historical rate movements on the Net Open Position of the Bank. FX translation risk arises from consolidation of Bank’s foreign currency investments overseas into local currency, and any other reserves held in foreign currency. This is continuously monitored by carrying out scenario analysis on net overseas investments.

- The USD/LKR market experienced a sudden devaluation of LKR by 3% on 21st November 2011 effective 22nd and as a result the LKR started trading around Rs. 113.90 per USD, prior to which it was trading around Rs. 110.35 per USD as depicted in the graph.

which are exposed to market risk factors. In certain instances, the Bank has set more stringent limits than the regulatory limits to ensure that the overall risk exposure is well within the risk appetite of the Bank.

Treasury related limits are periodically reviewed by the ALCO and sanctioned by the Board of Directors.

It is mandatory that Dealers sign the ACI model code-based ‘Code of Conduct’ to ensure that all dealing related activities are carried out maintaining ethical standards and acceptable trade practices.

Regular review of limits by ALCO and EIRMC ensures that the market risk remains within the Bank’s risk appetite as well as it works as a positive contributory factor in optimising risk-return trade off in the market portfolios to support business growth.

MRMU analyses Key Market Risk Indicators and carries out stress testing on various exposures vulnerable to fluctuations in market risk factors. These together with other market risk assessments are regularly reported for the perusal of the risk related management committees.

Market risk exposures created by non-trading activities such as retail and wholesale banking products and services are mainly managed through Assets and Liability Management (ALM) process of the Bank, within the Board approved ALM policy parameters.

Static Liquidity Gap Reports (Refer Note 35) are prepared based on all contracted cash flows. Dynamic Liquidity Gap Reports use certain assumptions on asset and liability classifications incorporating anticipated inflows and outflows. These reports are discussed at ALCO to identify actual cash flow mismatches and to initiate appropriate timely action to maintain overall liquidity risk of the Bank within the Bank’s risk appetite.

Tenor wise gap limits for short term time buckets and Management Action Triggers for MIS purposes are used for continuous monitoring of liquidity position of the Bank.

Core Funding Ratio, which provides an insight to the stability of funding sources that are used for onward lending purposes is another risk indicator that the Bank monitors for liquidity management and the Bank strives to maintain this ratio over and above 90% at all times.

Treasury related limits are periodically reviewed by the ALCO and sanctioned by the Board of Directors.

Market Risk Mitigation and Control

Board approved policies and guidelines act as the base on which risk mitigation and control mechanisms of the Bank are built on. Market risk related limits and guidelines are set out in the Assets and Liability Management Policy, Foreign Exchange Risk Management Policy and Derivative Policy. The limits in place may typically include Individual Dealer Limits, Portfolio Limits, Stop Loss Limits, Position Limits, Gap Limits, Tenor and Duration Limit. In addition to these risk management thresholds, various Management Action Triggers are also in place to notify the approving authorities of exposure levels reaching limits or of recurring loss events to facilitate prompt action to prevent adverse consequences well in advance.It is mandatory that Dealers sign the ACI model code-based ‘Code of Conduct’ to ensure that all dealing related activities are carried out maintaining ethical standards and acceptable trade practices.

Regular review of limits by ALCO and EIRMC ensures that the market risk remains within the Bank’s risk appetite as well as it works as a positive contributory factor in optimising risk-return trade off in the market portfolios to support business growth.

Market Risk Monitoring

Treasury Back Office is entrusted with the task of monitoring risk exposures created as a result of treasury related trading activities, against both the internally approved limits and regulatory limits. As an additional line of defence, Treasury Middle Office independently monitors market risk exposures, ensures that all Treasury transactions are carried out within the approved limits and reports any major observations to MRMU on a daily basis.MRMU analyses Key Market Risk Indicators and carries out stress testing on various exposures vulnerable to fluctuations in market risk factors. These together with other market risk assessments are regularly reported for the perusal of the risk related management committees.

Market risk exposures created by non-trading activities such as retail and wholesale banking products and services are mainly managed through Assets and Liability Management (ALM) process of the Bank, within the Board approved ALM policy parameters.

LIQUIDITY RISK

Liquidity Risk is the inability to fulfil due payment obligations by a bank in a timely manner or not at all, or in case of liquidity crisis only be able to procure financing at unfavourable terms. The main objective of liquidity risk management and controlling is to ensure that the Bank maintains its ability to make payments and undertake refinancing activities at any point in time in a profitable manner.Liquidity Risk Management Structure

Responsibility of managing and controlling liquidity of the entire Bank lies with the Assets and Liability Committee (ALCO) that meets at least on a fortnightly basis. Assets and Liability Management (ALM) desk of the Treasury reporting through Treasury Heads to ALCO, closely monitors and controls liquidity requirements on a daily basis to optimise the liquidity risk through proper coordination of funding activities.Liquidity Risk Exposures and Indicators

Bank has identified several key Liquidity Risk indicators, namely Liquid Asset Ratio, Net Advances to Deposit Ratio, Net Advances to Total Assets Ratio, Dynamic Liquidity Gap Summary (for all major currencies), Static Liquidity Gap Summary, Core Funding Ratio and Concentration in funding sources which are monitored on a regular basis in order to ensure that the Bank, maintains a healthy liquidity position.Static Liquidity Gap Reports (Refer Note 35) are prepared based on all contracted cash flows. Dynamic Liquidity Gap Reports use certain assumptions on asset and liability classifications incorporating anticipated inflows and outflows. These reports are discussed at ALCO to identify actual cash flow mismatches and to initiate appropriate timely action to maintain overall liquidity risk of the Bank within the Bank’s risk appetite.

Tenor wise gap limits for short term time buckets and Management Action Triggers for MIS purposes are used for continuous monitoring of liquidity position of the Bank.

Core Funding Ratio, which provides an insight to the stability of funding sources that are used for onward lending purposes is another risk indicator that the Bank monitors for liquidity management and the Bank strives to maintain this ratio over and above 90% at all times.

Market Risk Appetite

The Bank, based on its business strategy has developed a sound strategy to manage market risk, taking into consideration the level of market risk the Bank is willing to assume. This is mainly carried out through identification of appropriate products/market sectors and setting up appropriate risk tolerance limits for all identified portfoliosAdverse impact on concentrations in funding sources due to over reliance on single funding source/ wholesale depositors from liquidity perspective is another risk that the Bank is aware of. Strategies to reduce concentration on funding sources are long term in nature and the Bank’s ALCO is entrusted to plan such moves wherever it is necessary, on an ongoing basis.