Financial Review

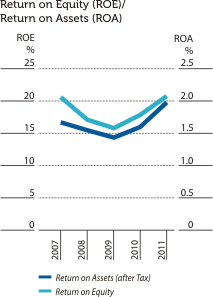

Graphical Review

performance of the strategic business units of the bank

The Bank’s income is derived from four main strategic business units: Personal Banking, Corporate Banking, Treasury and International Operations. The relative contributions of these business units in 2011 as compared to their performance in 2010 is tabulated below:| 2011 | 2010 | ||||

| BANK | Rs. Mn. | % | Rs. Mn. | % | |

| Profit before Tax | |||||

| Corporate Banking | 3,435.3 | 31.27 | 2,618.9 | 28.11 | |

| Personal Banking | 4,506.4 | 41.01 | 3,858.9 | 41.42 | |

| Treasury | 1,636.0 | 14.89 | 1,344.2 | 14.43 | |

| International Operations | 1,409.7 | 12.83 | 1,495.4 | 16.05 | |

| Total | 10,987.4 | 100.00 | 9,317.4 | 100.00 | |

| Loans & Advances | |||||

| Corporate Banking | 91,976.5 | 32.46 | 80,144.5 | 35.78 | |

| Personal Banking | 168,763.3 | 59.56 | 118,874.6 | 53.06 | |

| International Operations | 22,603.8 | 7.98 | 25,001.0 | 11.16 | |

| Total | 283,343.6 | 100.00 | 224,020.1 | 100.00 | |

| Deposits | |||||

| Corporate Banking | 39,607.5 | 12.44 | 30,366.0 | 11.69 | |

| Personal Banking | 253,179.3 | 79.50 | 204,958.8 | 78.90 | |

| International Operations | 25,674.7 | 8.06 | 24,454.0 | 9.41 | |

| Total | 318,461.4 | 100.00 | 259,778.8 | 100.00 | |