Financial Review

Credit Quality Ratios

The Bank’s gross non-performing ratio improved to 3.43% in 2011, from 4.22% in the previous year. This decrease can be linked to improved macroeconomic conditions, rigorous recovery efforts and the Bank’s substantial credit growth over the year. Provision cover and open credit exposure ratios of 39.53% and 14.26% respectively recorded substantial improvements of 5.48% and 4.35% compared to the previous year. Additional provisions made on prudential basis also helped to improve these ratios.Equity

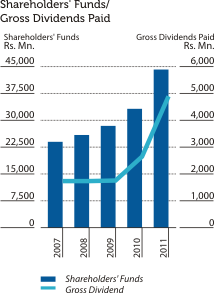

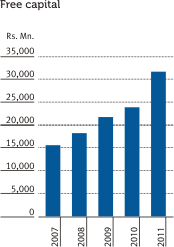

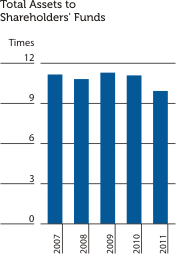

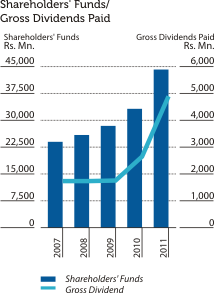

A dividend of Rs. 2.00 per share satisfied in the form of issue and allotment of shares was declared for 2010, which resulted in a capital infusion of Rs. 681 Mn. in April 2011. The Bank increased its stated capital by Rs. 4.86 Bn. in the third quarter through a rights issue of one new share for every existing 14 shares. Subsequent to this, the Bank announced a 1:1 share split, doubling the total number of shares, a measure that created additional market liquidity for the Bank’s shares. As a consequence of these developments, stated capital grew by 52.38% to Rs 16.47 Bn., up from Rs. 10.81 Bn. in 2010. Total shareholders’ funds also increased due to retained earnings. This included a reserve of Rs. 1.19 Bn. resulting from the funds transferred to the Investment Fund Account, being the taxes saved as proposed in the Government’s 2011 Budget. According to the budget guidelines, banks are required to transfer 8% of savings resulting from the Financial VAT rate reduction and 5% of savings from the corporate tax reduction to an Investment Fund Account, the funds of which can be utilised for activities specified by the Central Bank.Due to the prudent policies adopted over the time, the Bank was able to buildup shareholders‘ funds and free capital derived thereon which stood at Rs. 44.26 Bn. and Rs. 31.61 Bn. respectively, as at December 31, 2011. These are considered to be the highest among local private Banks.

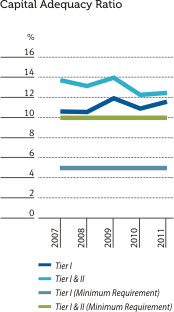

Capital Adequacy Ratios The Bank’s capital adequacy ratios improved in 2011, remaining at healthy levels throughout the year despite significant credit growth resulting from deliberate and sensible capital structure decisions. The Bank’s Tier I ratio improved to 12.11%, up from 10.87% in 2010, while the combined Tier I & II (total capital) ratio grew to 13.01%, up from 12.27% in 2010. The Bank continuously monitors and explores potential avenues for enhancing the capital base; with Tier I capital representing 93% of the total base. There are opportunities to increase Tier II capital. At the year end, the Bank was in the process of raising Rs. 1.0 Bn. through a debenture issue in early 2012.

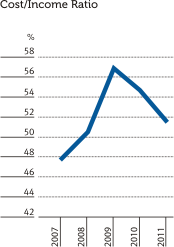

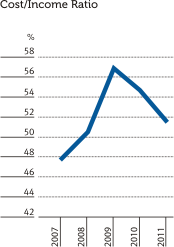

Cost/Income Ratio

Commercial Bank’s cost-to-income ratio, recognised as one of the best among Sri Lanka’s private banks, improved to 51.66%, down from 54.69% in 2010. This improvement was also supported by the reduced

financial VAT rate on profit. Excluding the financial VAT on profit, cost-to-income ratio increased marginally to 45.77%, up from 43.01% from the previous year's ratio.

Over the past years, productivity ratios improved as the result of several factors including higher pre-tax profits, the rationalisation of staff deployment, new automation initiatives and the centralisation of business processes. Pre-tax profit per staff member improved to Rs. 2.48 Mn., up from Rs. 2.22 Mn. in 2010, a gain of Rs. 0.26 Mn.

Comprehensive efforts toward deposit mobilisation, combined with improved efficiencies in staff deployment, increased the deposit-per-staff member to Rs. 72.01 Mn., up from the previous year’s figure of Rs. 61.91 Mn. In keeping with these increases, advances per staff member grew to Rs. 62.50 Mn., compared to Rs. 51.73 Mn. in 2010.

The Group’s pre-tax profit was Rs. 11.07 Bn., an increase of Rs. 1.77 Bn. or 19.01%, over the Rs. 9.30 Bn. total recorded in 2010. The Group’s post-tax profit was Rs. 8.10 Bn., up from Rs. 5.51 Bn., a gain of Rs. 2.59 Bn. or 46.92%.

Over the past years, productivity ratios improved as the result of several factors including higher pre-tax profits, the rationalisation of staff deployment, new automation initiatives and the centralisation of business processes. Pre-tax profit per staff member improved to Rs. 2.48 Mn., up from Rs. 2.22 Mn. in 2010, a gain of Rs. 0.26 Mn.

Comprehensive efforts toward deposit mobilisation, combined with improved efficiencies in staff deployment, increased the deposit-per-staff member to Rs. 72.01 Mn., up from the previous year’s figure of Rs. 61.91 Mn. In keeping with these increases, advances per staff member grew to Rs. 62.50 Mn., compared to Rs. 51.73 Mn. in 2010.

Group Performance

Two of the Bank's subsidiaries recorded satisfactory improvement in consolidated performance in 2011. Commercial Development Company PLC (CDC) and One Zero Company Ltd. recorded pre-tax profit growths of Rs. 297.99 Mn. and Rs. 13.90 Mn. respectively, while Commex Italy experienced a loss of Rs. 34.39 Mn., as its operations are yet to commence.The Group’s pre-tax profit was Rs. 11.07 Bn., an increase of Rs. 1.77 Bn. or 19.01%, over the Rs. 9.30 Bn. total recorded in 2010. The Group’s post-tax profit was Rs. 8.10 Bn., up from Rs. 5.51 Bn., a gain of Rs. 2.59 Bn. or 46.92%.

Dividend

The Bank’s dividend policy, designed to maximise shareholders’ wealth, has an impact on cash dividend distribution. In framing its distribution strategy, the Bank considers factors such as profits, profitability, stability of earnings, rate of growth and opportunities for investment. Gearing level and regulatory requirements are also considered. In support of this approach, the Bank distributed two interim dividends (for both voting and non-voting shares) in November and December 2011, amounting to Rs. 1.50 per share and Rs. 1.00 per share respectively. The Directors have recommended a final dividend of Rs. 3.50 per share for year 2011, which consists of a cash dividend of Rs. 1.50 per share and the balance entitlement of Rs. 2.00 per share satisfied in the form of issue and allotment of new shares, subject to the approval of the shareholders at the forthcoming Annual General Meeting. The dividend payout ratio in the form of cash dividend amounted to 40.63% in 2011 from 34.20% in 2010. The total dividend including the dividend satisfied in the form of issue and allotment of new shares will result in a payout ratio of 60.94%, compared to 47.91% in 2010. The Bank remains mindful of the dividend structure’s impact on capital and future growth rates, and therefore manages the entire process with great care.