Financial Review

Loan Loss Provision

Guided by a Central Bank Direction, the general provision for performing and overdue loans and advances was reduced from 0.9% at the end of 2010 to 0.5% at the end of 2011. This reduction was mainly due to improved macroeconomic conditions in the country. As a result, the Bank recorded a Rs. 499.55 Mn. reversal of its general provision, compared to the Rs. 157.031 Mn. provision made in 2010. The Bank recorded a Rs. 950.23 Mn. increase in its specific provisions mainly due to additional specific provisions made on a prudential basis during the year. Discounting the impact of additional provisions made on prudential basis, the requirements of specific provisions would have been marginally lower than the last year. This decrease reflected the impact of a lower interest rate regime and the improved macroeconomic environment as well as the success of pre and post-credit mechanism in the Bank.The Bank recorded a Rs. 854.53 Mn. reduction in corporate tax, mainly as a result of the lowering of the corporate tax rate from 35% in 2010 to 28% in 2011 and reversal of over provision of Income Tax relating to previous years. As a result, after tax profit amounted to Rs. 8.05 Bn., a substantial gain of Rs. 2.52 Bn. or 45.71% over the Rs. 5.52 Bn. figure recorded in 2010.

The Bank was able to significantly improve its effective tax rate following the reduction in corporate tax and the financial VAT on profit as announced in the Government’s 2011 Budget. These measures addressed a long-standing need to reduce the relatively high taxes imposed on the Banking industry, which limited banks’ ability to reinvest profits and ensure future expansion of their asset base.

Return on Assets & Return on Equity Ratios

Return on Assets increased to 1.98% as compared to 1.60% in 2010. This improvement was mainly due to the combined effect of the Bank’s improved performance and the decrease of the financial VAT and corporate tax rates. Return on equity improved to 20.76%, up from 17.87% in 2010, despite the increase of Rs. 4.86 Bn. in shareholders’ funds consequent to the rights issue of shares in 2011.The Bank’s earnings per share rose by Rs. 2.82 to Rs. 10.04 in 2011.

Business Volumes

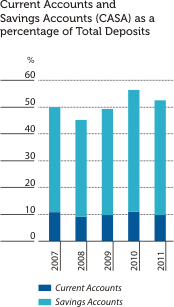

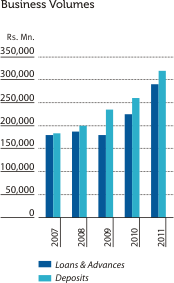

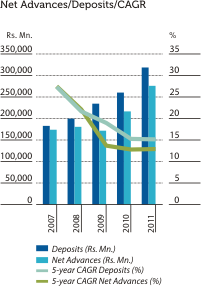

The Bank’s deposit volume increased by Rs. 58.68 Bn. or 22.59%, reaching Rs. 318.46 Bn. as of December 31, 2011. Fixed deposits recorded a higher growth compared to savings deposits - largely because of an increase in interest rates during the latter part of the year. Nevertheless, the Bank recorded a current accounts and savings accounts (CASA) ratio of 52.41% as of December 31, 2011 compared to 56.32% recorded at the end of 2010. It is pertinent to mention that the Bank maintains one of the best CASA ratios in the Sri Lankan banking industry, according to figures published up to September 30, 2011. The Bank’s presence in every corner of the country, coupled with its status as a national bank, acts as a catalyst for garnering new deposits. New customer service outlets opened, also accelerated the deposits mobilisation efforts of the Bank during the year.The steady growth in deposits stands in contrast to the sluggish credit growth recorded during the first half of the year. The resulting excess liquidity was invested in gilt-edged securities with relatively low yields. This trend was reversed when the Bank experienced an accelerated growth in loans and advances in the second half of the year. An increasingly widespread network of branches helped boost substantial growth in the retail-lending portfolio. At the same time, the Bank remained committed to strengthening long-standing relationships with its corporate clientele.

Net loans and advances reached Rs. 276.39 Bn. by end 2011, a phenomenal growth of Rs. 59.36 Bn. or 27.35% over the previous year’s total. The CAGR in net loans and advances over the past 10 years is 21%. The past year’s results were driven mainly by growth in fixed loans, overdrafts, leasing and loans against gold, especially during the latter part of the year.

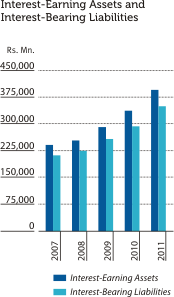

The Bank’s total assets stood at Rs. 441.10 Bn. as of December 31, 2011, an increase of Rs. 71.04 Bn. or 19.20% over the previous year’s total. Interest-earning assets represented 89.73% of total assets as of December 31, 2011 compared to 91.16% at the end of 2010.

Although liquidity in the banking industry was under pressure towards the end of the year, the Bank's liquidity position - both in the Domestic Banking Unit and the more tightly-regulated Off-Shore Banking Unit - remained at satisfactory levels. Nevertheless, the Bank’s liquid assets ratio dropped to 26.35% by year-end, compared to the 29.74% ratio recorded in 2010 - a decrease largely attributable to the growth in loans and advances. To help improve its liquid assets ratio, the Bank negotiated for a US dollar 65.0 Mn. facility from the IFC, which will be used to expand lending to Small and Medium Enterprises (SMEs) during 2012.