Our Strategy and Profile

The Bank serves over two million customers spread across corporate, institutional, public sector and retail including SMEs and individuals via an array of products, services and delivery channels. Details of the products and services offered and the delivery channels used to

serve our customers, categorised under four main business divisions of the Bank namely, Corporate Banking, Personal Banking, Treasury and International Operations are given below:

During the year under review, operations of the Bank generated a total income of Rs. 45.483 Bn. (Rs. 41.522 Bn. in 2010) and profit after tax of Rs. 8.048 Bn. (Rs. 5.523 Bn. in 2010). Total equity and debt by end-2011 stood at Rs. 44.227 Bn. and Rs. 0.973 Bn. respectively (Rs. 33.302 Bn. and Rs. 2.127 Bn., respectively at end-2010).

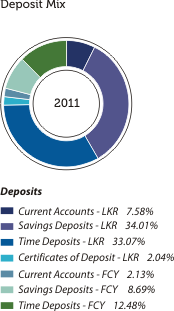

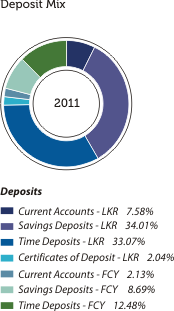

Details of the reporting by Business Segments and Geographical Segments, Sector-Wise Distribution of Loans and Advances and Deposit Mix are found in Notes 39.1, 39.2, 20.6 and 27 to the Financial Statements.

More information on the Bank’s income, profits, assets, business volumes, debt and equity together with ratio connected to key performance areas of the Bank is found in the Section on ‘Decade at a Glance’.

The Bank’s performance in 2011 compared to 2010 is summarised in the Section on ‘Financial Highlights’.

Details of the reporting by Business Segments and Geographical Segments, Sector-Wise Distribution of Loans and Advances and Deposit Mix are found in Notes 39.1, 39.2, 20.6 and 27 to the Financial Statements.

More information on the Bank’s income, profits, assets, business volumes, debt and equity together with ratio connected to key performance areas of the Bank is found in the Section on ‘Decade at a Glance’.

The Bank’s performance in 2011 compared to 2010 is summarised in the Section on ‘Financial Highlights’.

The principal business activities of Commercial Bank of Ceylon PLC and its subsidiaries and associates are found in the ‘Annual Report of the Board of Directors’.

Details of corporate profiles, Directorates and summary of financial information of Group Companies are found in the Section on ‘Group Structure’. Details of the business operations of the Bank during the year under review appear in the Section on ‘Management Discussion and Analysis’.

The functions outsourced by the Bank include:

Another important new concept launched during the year was that of priority banking services for selected customers at a specially-dedicated Elite Branch at No. 7, Gregory's Road, Colombo 07. The service profile of the Elite Branch may be described as ‘banking and beyond’, broadening and extending the concept of what a bank is for.

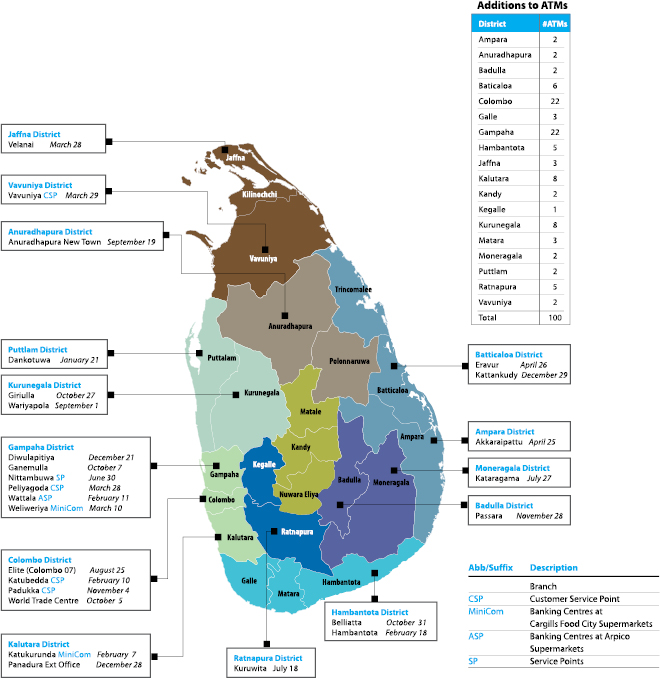

In addition to the Elite Branch, 25 new service-delivery points were opened this year. See map on ‘New Delivery Points and ATMs added in 2011’.

Five existing branches - at Ambalantota, Chilaw, Matugama, Nawalapitiya and Batticaloa - were relocated with a view to enhancing customer convenience.

During the year, the Bank raised funds by way of a Rights Issue of Ordinary Shares in order to strengthen its Tier I Capital Base. More information regarding this is found on Note 32 to the Financial Statements.

Details of corporate profiles, Directorates and summary of financial information of Group Companies are found in the Section on ‘Group Structure’. Details of the business operations of the Bank during the year under review appear in the Section on ‘Management Discussion and Analysis’.

The Public Face of the Bank

Commercial Bank is best known to its customers and the general public by its corporate imagery, which appears in its advertising, publicity materials, official publications, corporate website etc.Outsourcing

The Bank as a policy does not outsource key functions involving the use of its strategic capabilities since these are an important source of competitive advantage. However, it is always ready to outsource non-key functions if this will optimise sustainability and returns to stakeholders. The Bank periodically evaluates the credibility and capability of partners selected to provide outsourced functions.The functions outsourced by the Bank include:

- Sorting of cash and cash transportation

- Building maintenance and janitorial services

- Security services

- Transport services

- Back-office and support staff, including office helpers, typists and telephone operators

- IT support services

- Printing and dispatching bank statements

- Courier services

- Maintenance of the share ledger and related secretarial work

Significant Profile Changes in the Year Under Review

One of the significant development in the operations of the Bank in 2011 was the setting-up of an Islamic Banking Unit offering a full range of services to this growing sector.Another important new concept launched during the year was that of priority banking services for selected customers at a specially-dedicated Elite Branch at No. 7, Gregory's Road, Colombo 07. The service profile of the Elite Branch may be described as ‘banking and beyond’, broadening and extending the concept of what a bank is for.

In addition to the Elite Branch, 25 new service-delivery points were opened this year. See map on ‘New Delivery Points and ATMs added in 2011’.

Five existing branches - at Ambalantota, Chilaw, Matugama, Nawalapitiya and Batticaloa - were relocated with a view to enhancing customer convenience.

During the year, the Bank raised funds by way of a Rights Issue of Ordinary Shares in order to strengthen its Tier I Capital Base. More information regarding this is found on Note 32 to the Financial Statements.

New Delivery Points and ATMs Added in 2011

Awards and accolades

The Bank continued to be recognised through an array of awards and accolades during the year. They are tabulated below, together with those won during the past decade.| 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | |

| AA (lka) |

AA (lka) |

AA+ (lka) |

AA+ (lka) |

AA+ (lka) |

AA+ (lka) |

AA+ (sri) |

AA+ (sri) |

SL AA + |

SL AA + |

|

| AA+ | ||||||||||

| P1 | ||||||||||

| Entrant | Entrant | |||||||||

| Winner | Winner | Winner | Winner | Winner | Winner | Winner | Winner | Winner | Winner | |

| Winner | Winner | Winner | Winner | Winner | Winner | Winner | ||||

| Winner | Winner | |||||||||

| Winner | Winner | |||||||||

| Winner | Winner | Winner | ||||||||

| Winner | ||||||||||

| Overall | Winner | Joint 1st R. up | Joint Winner | 1st R. up | Winner | Winner | Winner | Winner | ||

| Banking Sector | Winner | 1st R. up | Joint 1st R. up | Winner | Winner | Winner | Winner | Winner | Winner | |

| Corporate Governance Disclosure | 1st R. up | 2nd R. up | Joint 1st R. up | Winner | Joint 1st R. up | Winner | ||||

| Corporate Social Responsibility | 2nd R. up | Joint 1st R. up |

Joint 2nd R. up |

|||||||

| Management Commentary | 2nd R. up | 1st R. up | 2nd R. up | Joint 1st R. up |

||||||

| Overall | Joint Winner | 1st R. up | 2nd R. up | Winner | ||||||

| Financial/Banking Sector | 1st R. up | Joint 2nd R. up |

Joint 1st R. up | Winner | Winner | Winner | Winner | Winner | Winner | |

| Corporate Governance Disclosure | 1st R. up | 2nd R. up | Winner | |||||||

| Overall | Winner | N/A | Winner | |||||||

| Large Scale Investments | N/A | Winner | N/A | N/A | ||||||

| Extra Large Sector | Winner | N/A | Winner | 2nd R. up | ||||||

| Banking Sector | Winner | N/A | Winner | Winner | ||||||

| Excellence in Performance Management Practices | Winner | |||||||||

| Block Buster Performance | N/A | N/A | Winner | N/A | ||||||

| Business and Financial Sustainability | N/A | Winner | Winner | |||||||

| Gold | ||||||||||

| National/Overall/Gold | Winner | Winner | Winner | |||||||

| Overall (Large Sector) | Winner | |||||||||

| Most Innovative HR Practice (Large Sector) | Winner | |||||||||

| Financial Sector (Com e-Load Product) | Silver | |||||||||

| Financial Sector (Com Bank Online Product) | Merit | |||||||||

| HR Awards 2010 - Super 10 | Gold | |||||||||

| Award for Talent Supply | Winner | |||||||||

| Bank's Achievements in Bangladesh Operations | ||||||||||

| AAA | AA+ | AA+ | AA+ | AA | AA | AA | AA | |||

| Winner | Winner | Winner | Winner | Winner | ||||||

| Winner | Winner | Winner | ||||||||

| Winner | ||||||||||

| Winner | Winner | Winner | ||||||||

| 2nd R. up | 2nd R. up | 2nd R. up | ||||||||

| Winner | ||||||||||

| Winner |