Corporate Governance

Governance Structure of

Commercial Bank

The Bank’s Governance Structure portrayed below demonstrates the linkage mechanism that ensures alignment of its business strategy and direction through effective engagement and communication with its owners, Board of Directors, Board Sub-Committees and Management. This mechanism assures that the Bank sustains its potential to deliver its promised value to the stakeholders.

Major External Steering Instruments on Governance

- Companies Act No. 07 of 2007

- Banking Act No. 30 of 1988 and amendments thereto

- Banking Act Direction No. 11 of 2007 of the Central Bank of Sri Lanka on ‘Corporate Governance for Licensed Commercial Banks in Sri Lanka’ and amendments thereto

- Code of Best Practice on Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission of Sri Lanka (a voluntary Code)

Major Internal Steering Instruments on Governance

- Articles of Association of the Bank

- Board of Directors’ working procedure

- Policy for secrecy of information, credit and other internal manuals

- Integrated risk management procedures

- Processes for anti-money laundering

- Processes for internal controls

- Bank’s Code of Ethics

Reference Web Links for Further Information

- Companies Act: http://www.drc.gov.lk/App/

ComReg.nsf/200392d5acdb

66c246256b76001be7d8/$

FILE/Act%207%20of%202007

%20(English).pdf - Banking Act: http://www.cbsl.gov.lk/pics_n_

docs/09_lr/_docs/acts/Banking

Act30_1988.pdf - Banking Act Direction

No. 11 of 2007: http://www.cbsl.gov.lk/pics_

n_docs/09_lr/_docs/directions

/bsd/BSD_2011/bsd_directions

_oct2011_LCB.pdf

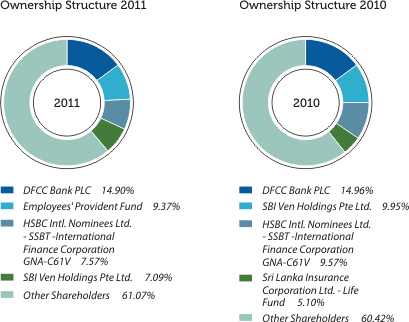

OWNERSHIP STRUCTURE

The right of shareholders to make decisions is exercised at the Annual General Meeting of the Bank and the Extraordinary General Meeting called upon as needed. According to the share register at year-end 2011, the Bank had a total of 9,299 voting shareholders. DFCC Bank PLC is the largest shareholder, with a stake of 14.90% of the Ordinary Voting Shares of the Bank. The Employees' Provident Fund has increased its voting shareholding to 9.37% in 2011 from 4.70% in the preceding year perking up its position to the second largest shareholder of the Bank.For further information on the ownership structure, please refer to Item 3 of the Section on ‘Investor Relations’ which deals with the Twenty Largest Shareholders of the Bank.

The information on ownership structure is published in the Interim Financial Statements of the Bank and it is also available on the Bank’s website, http://www.combank.net/newweb/interimfinancials

The information on ownership structure is published in the Interim Financial Statements of the Bank and it is also available on the Bank’s website, http://www.combank.net/newweb/interimfinancials

ANNAUAL GENENRAL MEETING 2011

The Bank’s 42nd Annual General Meeting (AGM) was held on March 30, 2011. At the AGM 332 shareholders were present by person or by proxy.The resolutions passed at the AGM were as follows:

| Approval of Annual Report of the Board of Directors on the affairs of the Company & Statement of Compliance and the Financial Statements for the year ended December 31, 2010. |

| Approval of a Final Dividend of Rs. 4/- to be made for 2010 (Satisfied by way of Rs. 2/- in Cash and Rs. 2/- in Shares) |

| Re-appointment /re-election of Directors in place of those vacating, retiring by rotation or otherwise. |

| Appointment of Ernst & Young, Chartered Accountants as the External Auditors of the Bank for 2011 and to authorise the Directors to approve their Remuneration. |

| Authorise the Board of Directors to determine donations for 2011. |