THE MACROECONOMIC ENVIRONMENT

Exchange Rate

There was significant pressure on the LKR/USD exchange rate throughout 2011, due to the general weakening of major Asian currencies against the USD. Adding to this pressure was a sharp rise in import demands - specifically, a higher influx of (a) investment goods as the result of expanding infrastructure projects, (b) intermediate goods in the form of petroleum imports and (c) consumer goods, notably motor vehicles. The Central Bank intervened in the domestic foreign exchange market to mitigate excessive volatility, supplying USD at regular intervals up to the fourth quarter. When market pressures increased, the LKR was ultimately depreciated by 3% according to a Budget proposal tabled by the Government in November 2011.Interest Rates

Many Sri Lankan banks increased their domestic rates even as monetary policy rates remained stagnant.| December | ||

| Key Interest Rates | 2010 % | 2011 % |

| Sri Lanka Inter-Bank Offered Rate (SLIBOR) |

8.16 | 9.01 |

| Average Prime Lending Rate (APLR) | 9.29 | 10.77 |

| One Year Treasury Bill Rate | 7.55 | 9.31 |

Credit to the private sector from the domestic banking units increased by 34.5% mainly due to the relatively low interest rate regime prevailed in the country during the year.

Investments

Investment growth in 2011 was directed primarily towards the construction of non-residential buildings and transport equipment, a typical pattern for a country in the process of rebuilding. It is expected that these increased investments will be attributable primarily to foreign sources, as domestic savings were projected to record a marginal decline.

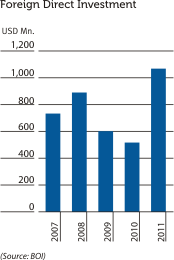

Foreign capital inflows were strengthened with a sovereign bond issue of USD 1.0 Bn. in July 2011 and Foreign Direct Investment (FDI) inflows of over USD 1.0 Bn.

Despite the end of the war, Foreign Direct Investment (FDI) inflows have not shown significant improvement. To induce higher levels of investment, Sri Lanka needs to develop physical and technological infrastructure, enhance human capital and improve labour market conditions as well as administrative capabilities.

Stock Market

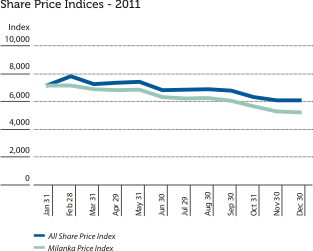

Stock market activity was somewhat subdued in 2011, compared to the unprecedented growth rates of 2010. The indices recorded increases throughout the first part of the year and declined thereafter. A total of 13 initial public offers attracted Rs. 19.0 Bn. from the market; in addition, 22 rights issues with a value of Rs. 26.0 Bn. were recorded during the year.

International Trade

Trade remained strong in 2011, with both import and export markets showing substantial growth. Export earnings increased significantly despite slower growth in traditional markets. There was also greater diversification in terms of markets served and products on offer. The rise in import was attributable to an increase in investment goods (for infrastructure development projects) as well as intermediate goods. Real income gains also led to higher imports of vehicles and non-essential goods.Other notable developments

According to the Department of Registrar of Companies, 5,993 new companies registered in the first nine months of 2011. This represents an increase of over 40% in comparison to the corresponding period in 2010.Tourist arrivals recorded 855,975 in 2011. This represents 30.8% increase over the previous year’s total. Tourism earnings for the year increased by 44.2%.

Worker remittances increased to USD 5.1 Bn. in 2011, an increase of 25% over the previous year. Remittances from abroad continued to be the leading foreign exchange earner, amounting to 8.7% of GDP - up from 8.3% in 2010. These gains were a major factor in containing the expanded trade deficit.

The Sri Lankan Government continued its fiscal consolidation efforts while maintaining public investment at high levels. The overall fiscal deficit was estimated at around 7% of GDP, down from 8% in 2010. As a result, the debt-to-GDP ratio fell to an estimated 78% in 2011. Fitch, Standard & Poor’s and Moody’s all gave Sri Lanka an improved sovereign rating during the year. The country’s global ranking in many areas also improved, helping to consolidate its status as a “Middle Income Emerging Market”.